Blog

Blog

Summer 2021 Internship Series: HP’s Internal Conflict (Minerals)

Oct 8, 2021

This blog post is part of the Summer 2021 Internship Series, where we highlight the works of our summer interns. Nina Crocco is the author of this particular post.

In the wise words of—well, probably your parents—you are the sum of who you surround yourself with.

From the friends you grab Saturday brunch with to your favorite coworkers, your vast social network often informs your decisions, attitudes, and morals.

In much the same way, the environmental, social, and governance (ESG) performance of a company is measured by the sum of its operational ecosystem. The only difference is that tech companies probably aren’t sharing bottomless mimosas with their semiconductor suppliers.

In order to minimize risk and attract stakeholders of all shapes and sizes (and hopefully out of the goodness of their own corporate hearts), companies are improving their ESG due diligence to create long-term, sustainable value.

Now more than ever, the focus is shifting from revenue to responsibility. Companies are devoting more resources to ensuring that they respect policies, procedures, people, the planet, privacy—you get the idea.

This involves looking inward at their supply chains and considering paid maternity leave and the hole they’re carving in the ozone… and everything in between. And we, as global citizens and responsible consumers, are certainly looking beyond their balance sheets.

In a perfect world, we would be looking for readily available, comprehensive ESG evaluations, but that process requires a fair share of blood, sweat, and tears.

Some of the setbacks include limited access to structured data, lack of standardized reporting, varying concerns by industry, consideration of supply chain networks, and the list goes on. Can you see why this keeps us up at night?!

Luckily, as companies feel the pressure to perform, many jump on the transparency bandwagon and publish annual sustainability and corporate responsibility reports.

What we can do in the meantime is grab a handy dandy notebook, sit down in the thinking chair, and dig into the claims companies are making about their performance (Yes, I’m talking full Blue’s Clues mode to uncover some bright red herrings).

In the hot seat today is HP Inc., a multinational leader in the production of tech devices, systems, services, and solutions and one of the first major IT companies to publish its suppliers.

As we would expect from an industry leader, HP provides yearly reports on its sustainable impact, covering topics from cybersecurity to product safety. The question at hand is if the company meets its own expectations.

With enough claims to feed a family of eight data analysts for weeks, where do you start?

I dove in head first by evaluating the hard-to-tackle assertion that HP does not tolerate corrupt behavior of any kind.

The presence of corruption including incidence of bribery and kickbacks within a supply chain isn’t easy to track. It’s one of those sneaky things where the parties involved keep it on the down low, so you often don’t know it’s happening until someone’s outed.

It’s like when you were younger, hearing your mom tell her friends that you were well-behaved and never snuck out. She would maintain that opinion until she caught you red-handed, climbing out of your window for the first time.

If she wanted to find out without giving up her 8 p.m. bedtime to surveil the house all night, she might look at that social network of yours mentioned earlier to see how likely your friends are to sneak out.

I took a similar approach, since investigating HP’s suppliers individually and waiting for a crumb of corruption to fall in my lap isn’t the best use of time. Instead, the goal was to assess the risk of corruption within the company’s supply chain.

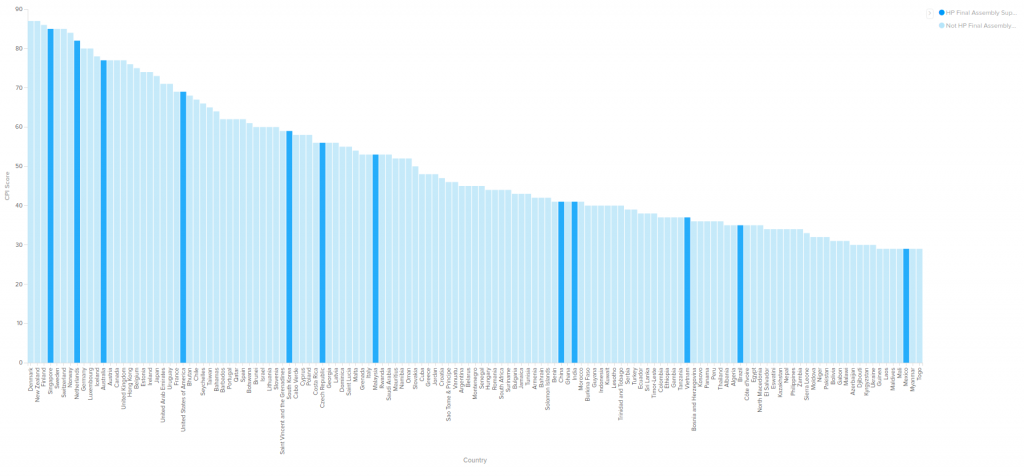

I cross-referenced HP’s final assembly supplier locations with Transparency International’s Corruption Perceptions Index, which gives perceived levels of public sector corruption for 180 countries. (The higher the score, the less corruption.)

The visualization below, courtesy of Tresata software, shows the distribution of HP supplier locations (highlighted) in terms of CPI score.

The average across the supply chain is 55, which beats out the global average of about 43. After applying this process to Samsung and Dell, the average for HP fell between that of its two competitors, suggesting average performance.

But even with the addition of a structured data asset, the analysis for this anti-corruption assertion could use some beefing up. Brownie points for HP for providing the number of workers on its lines at each supplier facility.

After weighting each country’s corruption index by the proportion of workers in the company’s supply chain, the data produced a new and improved average of about 41, which falls below the global average. Brownie points: retracted.

This is where our analysis tapers off, seeing as though Samsung, Dell, and most of HP’s other competitors don’t give out that extra information for free, which prevents a more accurate comparison. As we already knew, data access is everything.

In contrast to anti-corruption, responsible mineral sourcing seemed like a much more straightforward claim to evaluate for HP. How hard could it be to figure out how many of its mineral smelters are verified, right? Once you know they’re verified, then you can figure out their potential connection (or lack thereof) to human rights violations and forced labor.

Yes and no. HP’s Sustainable Impact Report asserts that any connection between the materials used in HP products and armed conflict or human rights abuses is unacceptable.

Conflict minerals such as tin, tungsten, tantalum, and gold—better known as 3TG metals—are raw minerals mined in regions such as the Democratic Republic of the Congo that experience just that: human rights abuses.

To represent its success numerically, HP asserts in its Conflict Minerals Report that greater than 99% of its 3TG smelters are compliant with the Responsible Minerals Assurance Process (RMAP), in the process of becoming so, and/or they reasonably believe exclusively source conflict minerals from recycled or scrap sources or from outside of the Covered Countries. RMAP is Responsible Mineral Initiative’s flagship program ensuring sustainable sourcing of minerals in companies’ supply chains.

When dealing with ESG oftentimes every bold claim comes with an asterisked disclaimer…

In this case, it’s HP later recognizing the impact of cobalt, a mineral that is often used in lithium-ion batteries and has sparked many debates over the associated human and labor rights, as a non-conflict material.

I investigated HP’s cobalt smelters, listed in its report on cobalt separate from the Conflict Minerals Report, by cross-referencing them with the Responsible Minerals Initiative’s list of active and conformant smelters. Only 79 % of HP’s cobalt smelters are either compliant with or in process of RMI’s initiative. If cobalt smelters are taken into account for HP’s conflict mineral facilities would yield only 98% for those that are compliant or in process.

The company knowingly has four cobalt smelters in its supply chain that are neither conformant nor active, meaning they either did not want to participate or didn’t meet standards. However, due to the nature of the industry these facilities pose a higher risk for irresponsible sourcing.

As reported, 17 of the 19 cobalt smelters in HP’s supply chain are in China, and four of those 17 are those non-participating facilities.

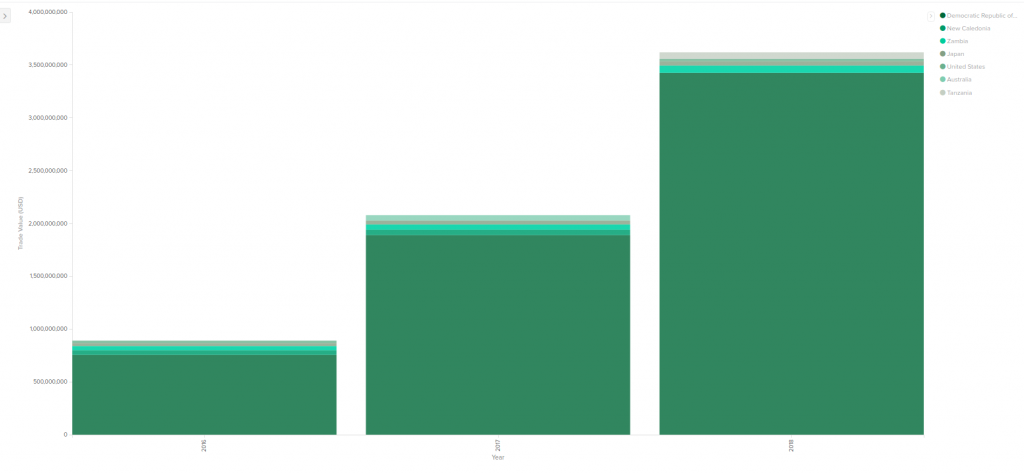

Why is this relevant? Because of the cobalt trade flows between the DRC and China.

The DRC is responsible for about 40% of yearly cobalt exports world-wide, while China is responsible for about 40% of imports.

To make that trade relationship a bit clearer, I exported trade flow data from the UN Comtrade database and pushed it through Tresata’s software to create the visualization below, which shows that the DRC accounts for 90-100% of China’s cobalt trade value.

Long story short, it is possible that the HP’s cobalt smelters located in China that are not participating in RMAP are irresponsibly sourcing cobalt from the DRC and supporting human rights violations, but without access to the data, it is impossible to know for sure.

HP relinquished responsibility for responsible mineral sourcing by stating that it’s 4-10 supply chain stages removed from its smelters. In defense of HP Inc., supply chain complexity does lay at the core of ESG evaluation and is what makes this problem so tricky. A key part of a comprehensive and structured ESG evaluation process is the transparent understanding of the supplier network – which is the exact capability that Tresata sustAIn enables. If you would like to find out more about how sustAIn automates data enrichment, transparent exposure of the value chain, and generation of predictive insights for a better ESG system, reach out to us at curious@tresata.com.